Debt-to-Equity D E Ratio Meaning & Other Related Ratios

This post was written by Kenon Thompson on January 19, 2022

It offers a comparison point to determine whether a company’s debt levels are higher or lower than those of its competitors. As is the story with most financial ratios, you can take the calculation and compare it over time, against competitors, or against benchmarks to truly extract the most valuable information from the ratio. By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions. Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle. This number can tell you a lot about a company’s financial health and how it’s managing its money. Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial.

Why You Can Trust Finance Strategists

Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. The company must also hire and train what is the difference between a ledger and a trial balance employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns.

What is a negative debt-to-equity ratio?

For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. For example, manufacturing companies tend to have a ratio in the range of 2–5.

What is your current financial priority?

The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

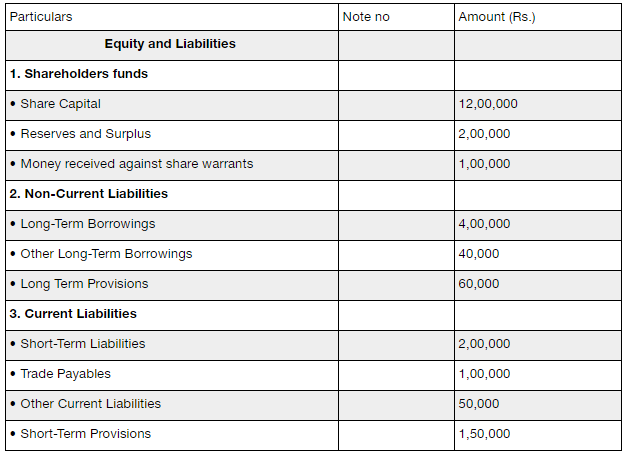

The debt to equity ratio is considered a balance sheet ratio because all of the elements are reported on the balance sheet. Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as copyrights and owned brands. Because the total debt to assets ratio includes more of a company’s liabilities, this number is almost always higher than a company’s long-term debt to assets ratio. Acceptable levels of the total debt service ratio range from the mid-30s to the low-40s in percentage terms. Last, businesses in the same industry can be contrasted using their debt ratios.

Advantages and Disadvantages of the Debt Ratio

Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. A highly leveraged company with a high D/E ratio faces increased financial risk. During economic downturns or challenging market conditions, the company may struggle to meet debt obligations, leading to potential default and loss of investor confidence. Yes, different industries have varying capital requirements and risk profiles, leading to sector-specific benchmarks for the debt/equity ratio. It is essential to compare a company’s D/E ratio with industry peers to gain meaningful insights.

- Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial.

- Using excel or another spreadsheet to calculate the D/E is relatively straightforward.

- The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022.

- The debt-to-equity ratio divides total liabilities by total shareholders’ equity, revealing the amount of leverage a company is using to finance its operations.

- In the realm of corporate finance, understanding a company’s financial leverage is critical for investors, creditors, and analysts alike.

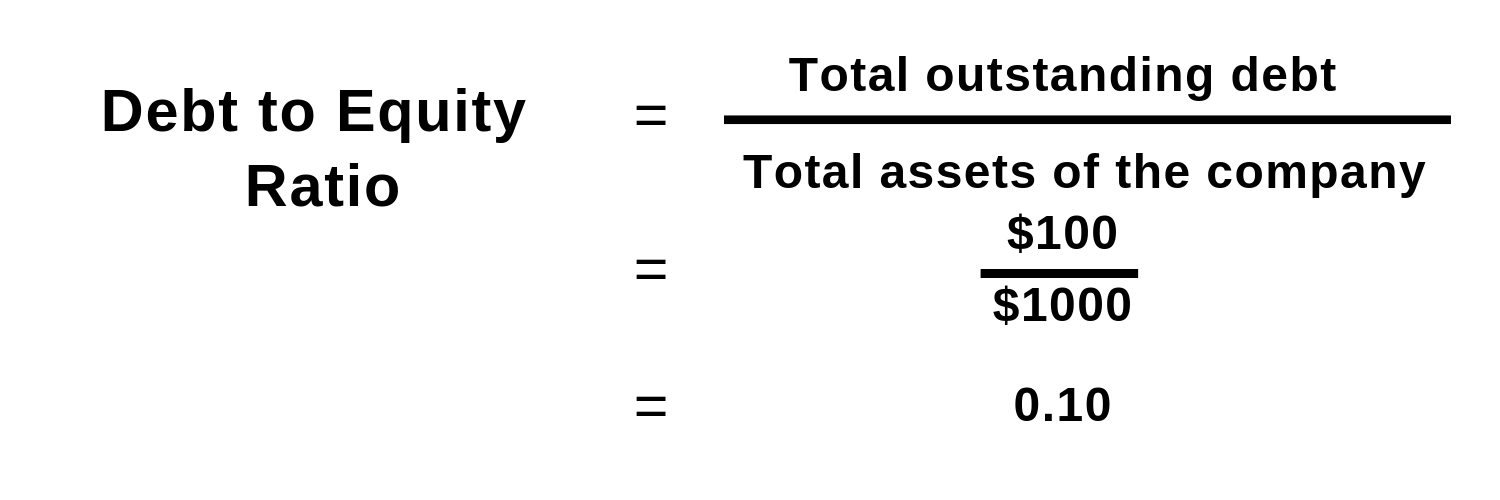

Gearing ratios are financial ratios that indicate how a company is using its leverage. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default.

If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry.

It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either. For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly. This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest. Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. But let’s say Company A has $2 million in long-term liabilities, and $500,000 in short-term liabilities, whereas Company B has $1.5 million in long-term debt and $1 million in short term debt.

It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy. In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet. However, this will also vary depending on the stage of the company’s growth and its industry sector.

TweetThis entry was posted on Wednesday, January 19th, 2022 at 10:03 am and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.