Wednesday, January 27th, 2021

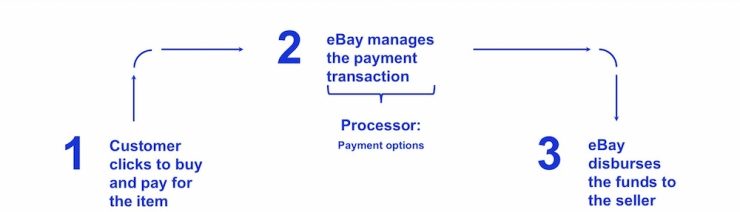

The more methods of payment you have, the higher the odds are of a client working with you. If a bookkeeper performs day-to-day tasks like data entry, a legal accountant looks at the big picture. They collect, analyze, and use financial information to plan for the future. With a legal accountant, you can be certain that your firm is compliant and is set to grow.

- Make sure your bookkeeping staff knows law firm accounting procedures.

- When holding money on behalf of clients or third parties, you need a trust account — which must be separate from your personal or business bank account.

- Accountants sometimes call this the “corporate veil,” and it’s what protects owners and their assets from any legal action taken against the company.

- Working with us will free you from the tedious accounting and bookkeeping tasks that are straining your time and resources.

- You can also use this information to identify what parts of your practice are most and least successful—so you can more thoughtfully allocate resources to stimulate future growth.

From an accounting perspective, a partner with no equity in the firm is still an employee. Refundable retainers — where the client may have a refund for hours prepaid but not worked during the month — are what accountants call unearned or deferred revenue. The retainer fee goes into a CTA, and you can draw from it as the client approves invoices for services rendered. Law firms can get in trouble when they withdraw unearned funds from CTAs. The money in a CTA isn’t immediately yours — you’re called a fiduciary, requiring you to exercise the highest standard of care with your client’s funds. You can only move CTA funds into your business operating account after your client approves an invoice.

Best Law Firm Accounting and Bookkeeping Services

And without proper care, it’s easy to slip up and make a dangerous error. If you’re going to make an accounting error, it’ll likely be with your trust and IOLTA accounts. This data lets you pick and choose the best clients to work with, identify what expenses you have that might not be worth it, and make sure you handle client money appropriately. Whether you’re a solopreneur or run a firm with a hundred lawyers, knowing where every dollar is going will help you make better decisions for the firm’s health. You’ll also identify what areas of your firm (practice areas, types of clients, etc.) are most profitable.

- If you’re just starting out and think you’ve set up your accounting the wrong way, talk to a professional accountant or bookkeeper with experience dealing with IOLTA.

- Get timely and reliable financial information about your firm so you can monitor your performance and make data-driven business decisions.

- We understand what it’s like to have everything fall on your shoulders.

- For a more in-depth look into trust accounting, read this article or download our law firm accounting guide on properly managing trust accounts.

- Bookkeepers record the financial transactions and balance the financial accounts for your firm.

Whether you’re good with numbers and spreadsheets or not, every lawyer needs to understand the basic role that bookkeeping plays in their business. Which method you choose will affect cash flow, tax filing, and even how you do your bookkeeping. Make sure to consult with a CPA before settling on the method you’ll use. It’s best to work with a CPA who has experience working with law firms. Ask other attorneys you know or ask your State Bar for referrals.

My Case Software Review: Our Favorite MyCase Software Features

Law firms juggle their clients’ money more than in most industries. Accountants in law spend much of their time tracking what money the firm earned and what needs to go to clients, the courts, or third parties. Our recommendation is Bench for lawyers looking to grow their practice and spend more time on revenue-generating activities such as client development or billing. Make one mistake when recording your debits and credits, and your entire balance won’t add up.

- We can fill all those functions, giving your firm one comprehensive, cost-effective, long-term solution for your back-office needs.

- When you take funds out of your business for personal use, it can either be classified as a capital withdrawal or as a payment for salary.

- With that said, knowing how to manage your money is also a reputation builder.

- The Trust Reconciliation – the trust bank statement provides a third-party verification to the transactions posted to the trust account.

- Again, you can bill the client to reimburse you for the expenses.

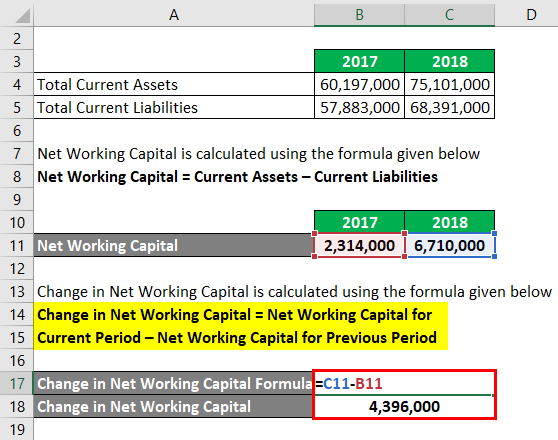

With the accrual method, you record revenue when it’s earned and expenses when they’re incurred—whether they’re paid right away or not. This creates a better matching law firm bookkeeping of costs to the revenues earned in a given month or year. It allows for more meaningful financial management that isn’t influenced by the ups and downs of cash flow.

Track your tax deductions

Most law firms should start by using the cash basis accounting method. The IRS won’t require you to use the specific rules necessary to implement the accrual method until you’re making $10 million a year. The cash basis accounting method is easier and more straightforward, which will free up your time to work on building your practice.

Your bar license is at stake any time your firm improperly moves client funds, even if you didn’t do it. Once you develop a bookkeeping system, business owners will want to consider working with a CPA or professional tax accountant around tax time to handle tax returns. While there are some outsourced services that offer this functionality, so far I’ve found that working with individuals and small accounting firms is better for this task. Here’s the list of tax accountants that we’ve vetted at the Biglaw Investor. The Less Accounting approach is more of a hybrid between the do-it-yourself approach and true outsourcing. For their initial plan, you can pay a monthly fee to access their software and manage your books yourself.

Posted in Uncategorized | No Comments »

Tuesday, January 26th, 2021

It’s important to identify a broker that is a good match for your investment needs. Calls work similarly to puts, but rather than giving the owner the right to sell a stock at a specific price, they give the owner the right to buy a stock at a specific price. If the stock stays at the strike price or above it, the put is “out of the money,” so the put seller pockets the premium. The seller can write another put on the stock, if the seller wants to try to earn more income.

An investor can also write a put option for another investor to buy, in which case, she would not expect the stock’s price to drop below the exercise price. It really depends on factors such as your trading objective, risk appetite, amount of capital, etc. The dollar outlay for in the money (ITM) puts is higher than for out of the money (OTM) puts because they give you the right to sell the underlying security at a higher price. But the lower price for OTM puts is offset by the fact that they also have a lower probability of being profitable by expiration. If you don’t want to spend too much for protective puts and are willing to accept the risk of a modest decline in your portfolio, then OTM puts might be the way to go.

Editorial integrity

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Jennifer Agee has been editing financial education since 2001, including publications focused on technical analysis, stock and options trading, investing, and personal finance.

Create a free account to unlock this Template

If the price of the underlying stock falls below the strike price before the expiration date, the buyer stands to make a profit on the sale. The buyer has the right to sell the puts, while the seller has the obligation and must buy the puts at the specified strike price. However, if the puts remain at the same price or above the strike price, the buyer stands to make a loss. A put option is a contract that allows an investor to sell a particular security, or other investment at a particular price for a specific amount of time. In the context of insurance, put options exist for life insurance policies.

Course Spotlight: Why you should tail those who fade the ball at … – PGA TOUR

Course Spotlight: Why you should tail those who fade the ball at ….

Posted: Wed, 09 Aug 2023 22:20:07 GMT [source]

A put option is the reverse of a call option, where the holder has the right, but not the obligation, to buy shares. Despite that, it doesn’t mean that these economic setbacks are any less painful. Most investors are aware that the stock market does go through phases of expansion and contraction. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Where have you heard about put options?

That is, the buyer wants the value of the put option to increase by a decline in the price of the underlying asset below the strike price. The writer (seller) of a put is long on the underlying asset and short on the put option itself. That is, the seller wants the option to become worthless by an increase in the price of the underlying asset above the strike price. Generally, a put option that is purchased is referred to as a long put and a put option that is sold is referred to as a short put. A put option gives the holder the right, but not the obligation, to sell a stock at a certain price in the future. When an investor purchases a put, she expects the underlying asset to decline in price; she may sell the option and gain a profit.

His net profit is $700 ($1000 – $300 option price]. However, if the stock price remains above the strike price, the (put) option will expire worthless. John’s loss from the investment will be capped at the price paid for the put. Suppose you hang on to the contract through expiration, but the stock price remains well above the strike price. The option would expire worthless and you’d only forego the $500 premium paid upfront for exposure to the theoretical equivalent of 100 shares of short stock. Put options work through an agreement, between a buyer and a seller, to exchange an underlying asset at a predetermined price by a certain expiration date.

Investors could short sell the stock at the current higher market price, rather than exercising an out of the money put option at an undesirable strike price. In general, the value of a put option decreases as its time to expiration approaches because of the impact of time decay. Time decay accelerates as an option’s time to expiration draws closer since there’s less time to realize a profit from the trade. An option’s intrinsic value is equivalent to the difference between the strike price and the underlying stock price. If an option has intrinsic value, it is referred to as in the money (ITM).

- Tastytrade and Marketing Agent are separate entities with their own products and services.

- If the stock price remains well above the strike price through expiration, you’d keep the credit received up front as profit.

- Potential losses could exceed any initial investment and could amount to as much as the entire value of the stock, if the underlying stock price went to $0.

- Derivatives are financial instruments that derive value from price movements in their underlying assets, which can be a commodity such as gold or stock.

- A stockholder can purchase a “protective” put on an underlying stock to help hedge or offset the risk of loss from the stock price falling.

The two main types of derivatives used for stocks are put and call options. If units of SPY fall to $415 prior to expiration, the $425 put will be “in the money” and will trade at a minimum of $10, which is the put option’s intrinsic value (i.e., $425 – $415). The exact price for the put would depend on a number of factors, the most important of which is the time remaining to expiration. You can make money from a put option if your speculation of the market movement is correct. As a long put holder, you can either sell the contact before expiry for a profit if there is a swift bearish movement in the stock price.

Sellers expect the stock to stay flat or rise above the strike price, making the put worthless. If the stock finishes between $37 and $40 per share at expiration, the put option will have some value left on it, but the trader will lose money overall. And above $40 per share, the put expires worthless and the buyer loses the entire investment. Assume an investor is bullish on SPY, which is currently trading at $445, and does not believe it will fall below $430 over the next month. The investor could collect a premium of $3.45 per share (× 100 shares, or $345) by writing one put option on SPY with a strike price of $430. Puts with a strike price of $50 are available for a $5 premium and expire in six months.

How we make money

Conversely, it’s “out of the money” (worthless) when the market price of the underlying stock is below the strike price. Puts with a strike price of $50 can be sold for a $5 premium and expire in six months. Buying puts offers better profit potential than short selling if the stock declines substantially. The put buyer’s entire investment can be lost if the stock doesn’t decline below the strike by expiration, but the loss is capped at the initial investment. Because one contract represents 100 shares, for every $1 decrease in the stock’s market price below the strike price, the total value of the option increases by $100. A stockholder can purchase a “protective” put on an underlying stock to help hedge or offset the risk of loss from the stock price falling.

At $45, the trade has already made a profit, while the put buyer has just broken even. The biggest advantage for short-sellers, though, is that they have a longer time horizon for the stock to decline. While options eventually expire, a short-seller need not close out a short-sold position, as long as the brokerage account has enough capital to maintain it. The owner of a put option profits when the stock price declines below the strike price before the expiration period. The put buyer can exercise the option at the strike price within the specified expiration period.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Our goal is to give you the best advice to help you make smart personal finance decisions.

- NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

- Tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc.

- Put owners don’t have to own the physical asset to secure the right to sell it if they exercise the option, which limits their monetary risk.

- The investor could collect a premium of $3.45 per share (× 100 shares, or $345) by writing one put option on SPY with a strike price of $430.

- If the strike price of a put option is $20, and the underlying is stock is currently trading at $19, there is $1 of intrinsic value in the option.

If the underlying stock’s market price is below the option’s strike price when expiration arrives, the option owner (buyer) can exercise the put option, forcing the writer to buy the underlying stock at the strike price. That allows the exerciser (buyer) to profit from the difference between the stock’s market price and the option’s strike price. But if the stock’s market price is above the option’s strike price at the end of expiration day, the option expires worthless, and the owner’s loss is limited to the premium (fee) paid for it (the writer’s profit). The right to sell the underlying asset is secured through paying a premium to hold the theoretical equivalent of 100 short shares of stock below the put strike for a limited amount of time. Since put buyers don’t have an obligation to short-sell the 100 shares, they can go the alternative route of letting the option expire worthless and only give up the premium paid up front. This is typically done if the stock price stays above the strike price.

Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero. If the market price is lower than the strike price at maturity, the investor can decide whether he will sell his option or not, but the seller is obliged to buy the security at the strike price. We want to clarify that IG International does not have an official Line account at this time.

Contrary to a long put option, a short or written put option obligates an investor to take delivery, or purchase shares, of the underlying stock at the strike price specified in the option contract. Assume an investor buys one define put option put option on the SPDR S&P 500 ETF (SPY), which was trading at $445 (January 2022), with a strike price of $425 expiring in one month. For this option, they paid a premium of $2.80, or $280 ($2.80 × 100 shares or units).

Posted in Uncategorized | No Comments »