Archive for March, 2022

Wednesday, March 30th, 2022

They display the closing trading price for a currency for the periods specified by the user. The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information in a trend line to identify breakouts or a change in trend for rising or declining prices. So, you can profit from the difference between two interest rates in two different economies by buying the currency with the higher interest rate and shorting the currency with the lower interest rate. For instance, before the 2008 financial crisis, shorting the Japanese yen (JPY) and buying British pounds (GBP) was common because the interest rate differential was substantial. Commercial and investment banks still conduct most of the trading in forex markets on behalf of their clients.

- The more leveraged your account and the larger the lot size you’re trading, the more exposed you are to a wipeout.

- The spread, calculated in pips, is the difference between the price at which a currency can be purchased and the price at which it can be sold at any given point in time.

- However, if that same investor thinks the euro will decline relative to the US dollar, they can sell the EUR/USD by opening a sell position for one lot of that pair.

- As they expand, however, they tend to invest more in advanced marketing strategies such as content marketing, SEO, and paid advertisements.

- Each broker that features forex investments has advantages and disadvantages.

- This requires taking the time to understand who your ideal customers are, what they need from a broker, and how you can best serve them.

In a mini lot, one pip equals $1 and that same one pip in a standard lot equals $10. Some currencies move as much as 100 pips or more in a single trading session making the potential losses to the small investor much more manageable by trading in micro or mini lots. Unlike the stock market, where you can buy or sell a single stock, you forex broker marketing plan have to buy one currency and sell another currency in the forex market. Next, nearly all currencies are priced out to the fourth decimal point. Now, you will notice that both short-term and long-term traders require a large amount of capital – the first type needs it to generate enough leverage, and the other to cover volatility.

Understanding forex trading

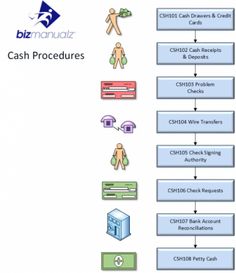

To start a Forex brokerage firm clients can rely on, ensure your trading platform functions without failures and delays in execution, especially during periods of liquidity swings. User-friendly UI and UX are also important, as well as the option to access the platform through web and mobile terminals. Twitter is another popular avenue when it comes to building connections with traders, as tweets are distributed quickly and allow companies to stay up to date with industry news and trends. LinkedIn is also an effective platform as it provides a professional forum for networking with other traders, brokerages, and financial institutions. Finally, YouTube allows brokers to create videos that provide educational content or demonstrations of their platforms. In the present day, Forex trading has become an increasingly popular form of investing.

The loss of client data or funds is one of the most devastating reputational risks an online brokerage company can face. Although it’s improved dramatically, you may still run into some forex brokerages that are less-than-reputable. The National Futures Association (NFA.futures.org) follows forex brokers and can help you verify a broker’s reputation. Typically a forex broker will offer you a price from the banks where they have lines of credit and access to forex liquidity. Many forex brokers use multiple banks for pricing, and they’ll offer you the best one available. The forex market is a global electronic network of banks, brokers, hedge funds, and other traders.

How Does the Forex Market Work?

Be suspicious if the broker doesn’t offer a demo account because it might be using an inferior or outdated platform. Forex market participants are not limited to banks and investment funds, but also include private traders trying to make money on exchange rate differences. All of them are using the services of such companies as FX brokers, but online traders are quite a motley crowd. You can’t set up a business that would cater to every known type of trader’s needs; instead, you need to decide on your target audience and the value you plan to bring. Therefore, to start a Forex brokerage business, you should absolutely include a preliminary preparation and break it down into several stages.

We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and an exhaustive list of other important fee-based data points. IG took first place for our 2023 Annual Awards as the best overall forex broker, with 100 available currency pairs and the ability to trade CFDs and forex options, traders have plenty of choices. IG holds nearly a dozen regulatory licenses (and holds the distinction of being the only forex broker regulated in both Switzerland and the U.S.); simply put, IG is one of the most trusted brokers in the industry. A practical Forex broker marketing strategy should include both digital and traditional marketing tactics to reach the right target audience. Digital marketing is essential for driving targeted traffic to your website, which is why investing in paid search engine advertising and pay-per-click campaigns can be particularly beneficial.

Forwards and Futures Markets

If you’d like to learn more about how CFDs work (and to see our picks for the best CFD trading platforms), check out our full-length guide to the Best CFD Brokers and Trading Platforms. Trading with a trusted forex broker is a crucial factor for success in international currency markets. As a contract for difference (CFD) trader or forex investor, you may have specific needs related to which platform, trading tools, or research requirements you have. Understanding more about your investment style needs can help determine which forex broker will be best for you. Forex offers many pros, including deep liquidity, 24-hour-a-day access, and access to leverage, which can help provide stronger returns.

Of course, there are many more nuances that make forex trading complex, which we’ll get into below. Line charts are used https://www.xcritical.com/ to identify big-picture trends for a currency. They are the most basic and common type of chart used by forex traders.

Focus on Digital Marketing and Paid Advertising

To benefit from it, it is crucial to constantly analyze the market and well-performing clients, so that market surges do not put the company out of business altogether. In this case, a correct assessment of your client’s behavior is the key. In this section, a business model refers to a model of operations, which ultimately affects the way a Forex brokerage business generates profits. This is a very important aspect determining both budgeting issues and possible risks.

The minimum deposits for forex trading accounts can be quite low and may not even apply at all. Due to the role of leverage in forex trading, however, it is a good idea to have enough risk capital in the account to actually engage in meaningful trading. Even if you can open an account with a $0 minimum, trading with smaller account balances is difficult and can severely limit the range of price action you can handle on any one position. Although there is no hard and fast rule, a balance of $2,500 in risk capital is a good starting point for developing your FX trading skills. The amount you are willing to risk along with how far you are willing to let the market move against your position before taking a loss sets the parameters of the trade. You should also set a take profit point if you intend to systemize your trading, but with the downside risk contained, you always have the option of letting winning positions run.

Are Forex Markets Volatile?

A forex broker is a financial services company that provides traders access to a platform for buying and selling foreign currencies. Forex trading is the exchange (or trading) of currencies on the foreign exchange market. Trading occurs in currency pairs such as the EUR/USD (the euro versus the U.S. dollar) and the USD/CAD (the U.S. dollar versus the Canadian dollar).

We have a bullish engulfing, Fibonacci support and a 100-day SMA support. Again, we see a Fibonacci resistance level that provides an excellent exit point. Note that we could break this trade into smaller trades on the hourly chart. If the exchange rate is higher when the trader closes the trade, the trader makes a profit.

Establishing relationships with liquidity providers

One balance is your actual balance, not including your open trades. Your other balance is the balance that you would have if you were to close all your trades. A forex broker works as an intermediary between you and the interbank system.

How to Choose a Forex Broker

Forex trading involves all the usual suspects, like retail traders, large investment banks, regional banks, private wealth management firms, corporations, and so on. Unlike other financial markets, however, governments are also active participants in the foreign exchange markets. Other primary FX market participants include the large international banks that make up the inter-bank market.

The purest form of a forex broker? An honest opinion on the ECN model

It delivers a terrific user experience, as well as advanced tools, comprehensive market research, and an excellent mobile app. Hands down, the CMC Markets Next Generation trading platform is a market leader that will impress even the pickiest of traders. The new Dynamic Trading tool allows you to place multiple trades simultaneously, which was a nice innovation by CMC Markets this year.

Posted in Uncategorized | No Comments »

Friday, March 18th, 2022

In James’s case, however, he was only using a fraction of the features. Just because a system has more features doesn’t mean it will serve a specific company to its highest degree. Every project is unique, even if there is a standard method in place. It’s the client’s problem that makes the project unique, and how the services team solved that very problem to the fullest extent.

Customer success vs customer experience vs customer support

While this case study shows that Jacobs Law Group satisfied their client and has good legal know-how, the language was clearly written by people with a deep knowledge of the law. Their case studies, while short, consistently use complicated language and terms without much explanation. Customer success stories must be clear and easy to understand; otherwise, their impact suffers. In conclusion, there are several examples of successful companies across different industries, including cloud platforms, service organizations, and product companies. These companies have set the bar high for others to follow by providing high-quality products and services, effective marketing campaigns, and a commitment to innovation.

- It’s not hard to see why considering solving problems themselves can be faster than waiting to speak with an agent in some cases.

- This strategy not only helped others earn but also enhanced our brand image with real-life success stories.

- Dive into these unique perspectives to enhance your approach to customer storytelling.

- The CSM’s job is not just to answer questions, but to understand why the question was asked and how the customer will benefit from that answer.

- The advanced segmentation capabilities of this onboarding software can also help you improve your in-app messaging and tailor it towards your customer success goals.

- Once the content is finally ready and published on social media, you’ll want to track its success.

Effective Feedback

Ensure you pull customer success metrics showcasing increased sales, reduced time and resources, improved efficiency, and reduced costs. Showcasing this data will help you reinforce the message that prospects can do the same thing. Additionally, incorporating success stories into sales presentations can be highly effective in showcasing the value of your product or service. By tailoring the Customers Success Stories story to resonate with the audience and highlighting key benefits, you can effectively demonstrate how your solution can bring tangible results. Utilizing visuals, such as infographics or charts, can further enhance the impact and outcomes of the success story. And by crafting a captivating narrative, you can truly engage the audience and showcase the transformative effect of your solution.

Air India delivers effortless, world-class service with Einstein.

NPS score tells you how likely a user would recommend your product to others. This will give you a clear idea of their true satisfaction level and loyalty which makes it an invaluable metric when trying to retain customers. Some time ago I received a question from a customer that seemed quite urgent. It was already late in the day, but I still wanted to answer quickly and not make the customer wait until the next day. He asked what seemed to be a simple question, which I answered quickly without trying to understand the reasoning behind the question or the use case.

I once had a client who expressed to me that they were nearly bankrupt and paying their bills with credit. Originally, they were set up on a contract where the renewal came due yearly. While this was preferred for the company, I explained the downside and upsides to changing to a monthly bill.

Our Artificial Intelligence Client Success Stories BCG – BCG

Our Artificial Intelligence Client Success Stories BCG.

Posted: Fri, 02 Feb 2024 21:34:35 GMT [source]

This type of content is more likely to capture the attention of prospects and keep them engaged throughout the sales process. As a last step, we want to suggest you organize the success story in the usual way your readers expect to see it. Have a clear introduction, a body filled in with the customer’s journey, and a conclusion that showcases your product’s impact. Throw in the visuals + quotes + call-to-action, and you’ll have an engaging and persuasive narrative that leaves a lasting impression on potential customers. Customer success stories can also provide valuable feedback to companies.

Affiliate program: Gathering stories for free

- These are real situations with real people, and they need to be authentic—otherwise you’re setting potential clients up for disappointment.

- It should start with the client’s problem or challenge, followed by how they implemented the product or service and the positive outcomes they achieved.

- All case studies are linked, in case you’d like to examine them further.

- Yours happens to be a particularly special project, and we’d love to promote your brand by showcasing the results.

- When they read about how you helped a client solve said problem, they’ll find parallels.

- They knew from experience that personal case studies resonate with audiences.

How to measure customer success? Key metrics to track

Posted in Uncategorized | No Comments »

Tuesday, March 15th, 2022

These include the identification of spare capacity and the fostering of cost reduction by comparing the resources required under ABC with the resources that are currently provided. This provides a platform for the development of activity-based budgeting in which the resource relationships identified by ABC are used to project future resource requirements. ABC provides cost driver rates and information on transaction volumes which are very useful to management for cost management and performance appraisal of responsibility centres. Cost driver rates can be used advantageously for the design of new products or existing products as they indicate overhead costs that are likely to be applied in costing the product.

What are the major difficulties of ABC?

One of the main challenges of ABC is that it requires a lot of data collection and analysis to identify, measure, and assign the activities and cost drivers. This can be time-consuming, costly, and complex, especially if you have a large number of products, services, processes, and customers.

As finance leaders adopt more detailed costing methods, they should also consider the calculation frequency and the costing time period. A move from year-to-date to monthly or quarterly periodic costing will improve opportunities for trending. For many organizations, a quarterly processing cycle will strike the right balance between a timely refresh of costing data and demands on staff time.

Advantages of Activity Based Costing

For such comprehensive installations, it is difficult to maintain a high level of management and budgetary support as the months roll by without installation being completed. Success rates are much higher for smaller, more targeted ABC installations. The advantage of an ABC system is the high quality of information that it produces, but this comes at the cost of using a large number of cost pools – and the more cost pools there are, the greater the cost of managing the system. To reduce this cost, run an ongoing analysis of the cost to maintain each cost pool, in comparison to the utility of the resulting information.

What are 3 limitations of activity-based costing?

The disadvantages of the ABC method include it being expensive to implement, as well as maintenance, being a time-consuming process, being used only for internal reporting, and having the possibility of some excluded costs.

Assigning cost based on anything other than the general ledger (GL) can lead to variances that may cause stakeholders to question the results. Addressing any deviation from the general ledger is warranted and will lead to more confidence in the costing data. An ABC system has the most impact on firms that have areas with large, increasing expenses or have numerous products, services, customers, processes, or a combination of these. Example are plants that produce standard and custom products, high-volume and low-volume products, or mature and new products. ABC identifies the real nature of cost behaviour and helps in reducing costs and identifying activities which do not add value to the product. With ABC, managers are able to control many fixed overhead costs by exercising more control over the activities which have caused these fixed overhead costs.

Resources for YourGrowing Business

Therefore, P&L managers need to use ABC with caution and judgment, and supplement it with other methods or tools when necessary. The company has to bear various customer costs apart from the cost of product production, like consumer services, return product handling, cooperative marketing, etc. The ABC costing system can help sort this additional cost and help the management identify profitable customers.

- Six of eight studies used direct observation [1, 2, 5, 8, 13, 14], two interviewed hospital staff [1, 14], two used electronic hospital records [2, 14], and two did not specify the method that was used [7, 9] (Table (Table1).1).

- Thus, the activity based system system uses activities instead of functional departments (Cost Centers) for absorbing overheads.

- ABC produces more accurate costing of products by essentially converting broad indirect costs into direct costs of production.

- This analysis may result in some unprofitable customers being turned away, or more emphasis being placed on those customers who are earning the company its largest profits.

- Efficient distribution of products to consumers is a major task for any entity.

Insights from TDABC modeling were most commonly applied to increase operational efficiencies, reduce waste, enable accurate cost comparisons, and mitigate risk under bundled payments. Additionally, publication bias may inflate the utility of TDABC as only those articles that found and demonstrated utility of applying this methodology are likely to get published. Activity-based costing (ABC) is a costing method that assigns overhead and indirect costs to related products and services. This accounting method of costing recognizes the relationship between costs, overhead activities, and manufactured products, assigning indirect costs to products less arbitrarily than traditional costing methods. However, some indirect costs, such as management and office staff salaries, are difficult to assign to a product.

Benefits of a Tiered Approach to Activity-Based Costing

Getting into the weeds can make it difficult to track data without an elaborate (and tried and true) system. Not to mention, some businesses don’t have the job positions and resources to manage an ABC system. Read on to learn the basics of what activity-based costing is, how to find it, and how it can help your business. When ABC is reportedly used in the public administration sector, the reported studies do not provide evidence about the success of methodology beyond justification of budgeting practise and existing service management and strategies. Beyond such selective application of the concept, ABC may be extended to accounting, hence proliferating a full scope of cost generation in departments or along product manufacturing.

This lump of unallocated overhead costs must nonetheless be met by participations from each of the products, but it is not as large as the overhead costs before Activity-based costing is used. Although some may argue that costs undetectable to activities should be “randomly allocated” to products, it is significant to understand that the only purpose of Activity-based costing is to provide information to administration. Traditional costing applies an average overhead rate to direct production costs based on a cost driver (e.g., hours or volume). Activity-based costing is a process whereby you can assign operational costs and overheads to the specific products or services that they relate to. It’s mostly used in manufacturing, as it’s much easier to work out the cost of all the activities required to make a certain product in this industry. In this article one of costing systems, activity-based costing system (ABC), investigated with differences of traditional systems.

ABC requires identifying and measuring the activities and cost drivers that consume resources, and collecting and analyzing data on the usage of those resources by the products or services. This can involve a lot of time, effort, and expertise, and may require sophisticated software and systems. ABC also requires updating and revising the cost information regularly, as the activities and cost drivers may change over time.

Implementation is Expensive

Those who are not in favor of activity based costing has spoken and thought that this can be a time-consuming process not to mention expensive. Well, the analysis of business activities will require the breaking down of individual components in each activity. However, the entire process should be able to utilize valuable Limitations of Activity Based Costing resources in the collection, measurement, and entering of data into a new system. Likewise, this can require the assistance of consultants specializing in the setting up of activity based costing and can also provide training regarding its use. Sometimes, another added expense may include the use of software for its implementation.

It is very important to find out the things that determine the cost of an activity. Unfortunately, there isn’t a costing method that gives you a completely accurate breakdown of your costs. So although an ABC system is more accurate and detailed than traditional costing, it isn’t 100% accurate.

Posted in Uncategorized | No Comments »

Monday, March 14th, 2022

It encompasses a variety of day-to-day tasks, including basic data entry, categorizing transactions, managing accounts receivable and running payroll. When doing the bookkeeping, you’ll generally follow the following four steps to make sure that the books are up to date and accurate. Remember that each transaction is assigned to a specific account that is https://simple-accounting.org/nonprofit-accounting-a-guide-to-basics-and-best/ later posted to the general ledger. Posting debits and credits to the correct accounts makes reporting more accurate. Take a look at the following four steps to manage your bookkeeping. If you plan to run your bookkeeping business or accounting firm off of Xero, then Xero Practice Manager could be worth looking into as it integrates very well into it.

- There’s good news for business owners who want to simplify doing their books.

- This is not the time to be cute, unless you can also be clear about what it is that you do.

- Once you become more established, clients will find you through word of mouth but plan to always market.

- Finally, having meetings at your home might make your clients feel uncomfortable.

- The only way to make that transition a reality is by time management.

With a growing digital presence, businesses need to stay abreast with the latest developments. Turning a side hustle into a main hustle can be daunting and disorienting. Some common advice with side hustles is to “niche down” and get really specific with your goals. Niche down means to specialize in a specific area and clarify which niche of your market you fill—and how. Maybe your side hustle is making soaps, but your niche might be making organic soaps or products for kids.

Best High-Yield Savings Accounts Of September 2023

While most bookkeepers work with businesses, some individuals may also choose to hire a bookkeeper to track personal finances. Whether you’ve been in the accounting industry for years or you’re considering starting a bookkeeping business with no experience, there’s something for you to learn in this article. Additionally, an experienced bookkeeper can help business owners gain a better understanding of their company’s financial processes. Business owners can use this data to optimize financial performance and keep a close eye on their cash flow. The key to time management is creating an effortless bookkeeping accounting system. Key Performance Indicators, or KPIs, help business owners determine how their business is progressing over time.

A bookkeeper keeps track of money coming into and out of a business by maintaining accurate financial records. A business plan is a detailed overview of how you plan to launch and grow your business. There are several key elements that are typically included in a comprehensive business plan. Here’s what yours might look like as you draft a plan for your bookkeeping business. There may be additional steps required if you plan to hire employees for your business. For instance, you may need to obtain workers’ compensation insurance.

How Seth Williams’ Real Estate Blog Earns Up To $60k/Month From Content Marketing & Courses

According to Entrepreneur, independent bookkeepers make between $25 and $40 per hour depending on where they work and the nature of the job. As you become more established and gain more clients, you may consider bringing in a partner or small staff. Some bookkeepers establish larger companies with hundreds of clients but first, you have to land enough clients to sustain yourself, personally.

Their acute attention to detail catches the subtlest of discrepancies, while their analytical skills uncover hidden insights. Christopher Jan Benitez is a professional freelance writer who provides small businesses and startups with content that aims to grow their engagement and conversion with their audience. Content marketing is consistently putting out content Best Accountants for Startups that your target audience will find useful. This method will help you connect with potential clients, get them interested, and turn them into new customers. To become NACPB certified, you must finish courses in bookkeeping, payroll, QuickBooks Online, and accounting. When setting prices, successful businesses take into account the most important factors.

Step 3 – Establish the Business

In an ever-changing environment, it is important to know the tools, trends, and strategies for building a strong online presence to allow your business to grow. Market research involves understanding key aspects of your current and future customers. To get a clear sense of your target market, outline the characteristics of your audience—for example, age, location, gender, income, job title, and key pain points. You need an assortment of resources like funds, skills, and knowledge.

Posted in Uncategorized | No Comments »

Thursday, March 10th, 2022

The new asset is unique, gets a new ID and represents 25% of the original asset. The asset is one unit and gains the accumulated depreciation of $83.33, and the net value is $416.67. It doesn’t matter which vendor is displayed since journal entries are not linked to a vendor. A business must determine Journal entry for depreciation the useful life of the asset, which will vary depending on the type of asset, or asset class. Global and regional advisory and consulting firms bring deep finance domain expertise, process transformation leadership, and shared passion for customer value creation to our joint customers.

Türkiye Begins Rolling Back Costly FX-Protected Deposits – Asharq Al-awsat – English

Türkiye Begins Rolling Back Costly FX-Protected Deposits.

Posted: Sun, 20 Aug 2023 07:03:14 GMT [source]

The practice details the lifecycle of an asset, such as purchase, depreciation, audits, revaluation, impairment and disposal. In a company’s books, each asset has an account, where all the financial activities related to fixed asset are recorded. Depreciation expense is considered a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations.

Getting New Equipment? You’ll Need to Make a Purchase of Equipment Journal Entry

With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. In accounting, software for internal use is treated differently from software purchased or developed to sell to others. Fixed assets usually form a substantial investment for an organization, and each asset can include many components requiring special attention. If you can’t measure the value of an exchanged asset, carry over the value of the original asset.

Bread-Short Tunisia to Restore Flour Supply to Some Bakeries – Asharq Al-awsat – English

Bread-Short Tunisia to Restore Flour Supply to Some Bakeries.

Posted: Sun, 20 Aug 2023 15:48:02 GMT [source]

At the end of the year, Big John would record this depreciation journal entry. It’s a common misconception that depreciation is a form of expensing a capital asset over many years. Depreciation is really the process of devaluing the capital asset over a period of time due to age and use. Depreciation and accumulated depreciation shows the current value or book value of the used asset. Component accounting or component depreciation assigns different costs to different parts of a large property, plant or equipment asset.

Put another way, accumulated depreciation is the total amount of an asset’s cost that has been allocated as depreciation expense since the asset was put into use. One of the advantages of the straight-line method is that it is easy to understand and apply. Additionally, it provides a consistent and predictable depreciation expense over the useful life of the asset, which can be helpful for budgeting and financial forecasting. Request a demo with us and see how you can centralize, manage, and automate journal entries with journal entry automation & management software. This provides a complete journal entry management system that enables accountants to create, review, and approve journals, then electronically certify and store them with all supporting documentation. The accelerated depreciation method calculates a faster rate of depreciation in the early life of the asset, which is beneficial for tax purposes.

Is there any other context you can provide?

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. With this method, your monthly depreciation amount will remain the same throughout the life of the asset. Deosai Co. has recently bought some office equipment including personal computers for $5,000.

The depreciation rate may vary depending on the type of asset, the method of depreciation used, and other factors. In contrast, items such as cash and accounts receivable are considered short-term assets because they are liquid, meaning they can be converted to cash in less than a year. They are purchased and owned by the business to support its operations. Companies come to BlackLine because their traditional manual accounting processes are not sustainable.

Although recording depreciation charge straight in the asset account is simple and clear as we can see above but it has one major problem. It distorts the information as it is “taking out” an important piece of financial statement. When you place an insurance claim on fixed assets, you must take certain accounting steps. Remove the asset from your books, but record the payout as a proceed.

What Are Fixed-Asset Clearing Accounts?

Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company. Finally, depreciation is not intended to reduce the cost of a fixed asset to its market value. Market value may be substantially different, and may even increase over time.

A fixed asset is a tangible piece of property, plant or equipment (PP&E); a fixed asset is also known as a non-current asset. An asset is fixed because it is an item that a business will not consume, sell or convert to cash within an accounting calendar year. The declining balance method is another method for calculating depreciation, and it is also known as the reducing balance method. This method is particularly useful for assets that are expected to lose value more quickly in their early years of use and then decline at a slower rate over their useful life. In accounting, depreciation is recognized as an expense that reduces the value of the asset on the balance sheet over its useful life.

Synder provides a comprehensive solution for recording the transactions in bulk – daily summaries. Stay up to date on the latest corporate and high-level product developments at BlackLine. Check out our most recent webinars dedicated to modern accounting.

How Are Accumulated Depreciation and Depreciation Expense Related?

An asset is also a resource the value of which you can dependably measure. Entities record their purchase of a fixed asset on the balance sheet, Asset purchases used to be noted on a sources and uses of funds statement, which is now called a cash flow statement. The Internal Revenue Service (IRS) requires businesses to record depreciation expenses in their tax returns.

They also ensure that accounting departments record and track assets correctly as well as handle tax accounting requirements for fixed assets. Asset impairment is akin to an advanced depreciation, which is when you reduce the potential benefit from an asset. When fixed assets undergo a significant change in circumstance that may reduce their gross future cash flow to an amount below their carrying value, apply an impairment test. To record the purchase of a fixed asset, debit the asset account for the purchase price, and credit the cash account for the same amount.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Depreciation on Equipment Journal Entry

GAAP only allows downward adjustments from historical cost, which are called impairment losses. This is a difference from IFRS, which allows for both upward and downward asset revaluation. Big John’s Pizza, LLC bought a new pizza oven at the beginning of this year for $10,000. Big John, the owner, estimates that this oven will last about 10 years and probably won’t be worth anything after 10 years.

These are the straight-line method, double declining balance method (DDB), Sum of the Year Digit method (SYD), and Unit of Production method. There are a few ways you can calculate your depreciation expense, including straight-line depreciation. Straight-line depreciation is the easiest method, as you evenly spread out the asset’s cost over its useful life. And, make an equipment journal entry when you get rid of the asset.

The Accounting University with 3400+ Accounting contents as study material which can watch, read and learn anyone, anywhere.

Working capital, cash flows, collections opportunities, and other critical metrics depend on timely and accurate processes. Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. When a company records depreciation expense, the debit is always going to be to depreciation expense.

- Depending on the value of the asset, a company may need to record gain or loss for the reporting period during which the asset is disposed.

- Second, it is a reduction in the value of an asset on the balance sheet.

- Streamline and automate detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching all in one centralized workspace.

- This helps the business arrive at a more accurate accounting of its income and related expenses.

- At the end of every accounting period, a depreciation journal entry is recorded as part of the usual periodic adjusting entries.

- BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate.

The IRS may audit businesses to ensure that they are complying with the guidelines for calculating depreciation and recording depreciation expenses. Failure to comply with the guidelines can result in penalties and fines, which can be costly for businesses. The purpose of the journal entry for depreciation is to achieve the matching principle. In each accounting period, part of the cost of certain assets (equipment, building, vehicle, etc.) will be moved from the balance sheet to depreciation expense on the income statement.

You’ll also want to create a liability record for the loan and record the loan as a debt. If the organization has not yet received the asset, it is still a current asset, not a fixed asset. Gain on disposal is calculated by subtracting the accumulated depreciation from the original cost of an asset and then adding the sales amount. In this example, the asset was purchased for $100,000, and accumulated depreciation is $80,000. A buyer paid $54,000 cash for the asset, which results in a gain on disposal of $34,000.

Posted in Uncategorized | No Comments »