T-Account: Definition, Example, Recording, and Benefits

This post was written by Kenon Thompson on November 28, 2023

To avoid bill shock, check with your service provider before you travel to see what options are available. Many providers offer plans that cover international roaming for a flat daily fee or as an additional monthly charge. For frequent travelers, there are also international plans that offer talk, text, and data coverage for an additional monthly fee. By planning ahead and selecting the right plan, you can stay connected without breaking the bank. You also want something that can be picked up by anybody and understood. You don’t want a tax official, VC, bank, or anyone else confused by your work.

Example of T accounts in action

This ensures a complete record of financial events is tracked and can be accurately represented by financial reports. It is a good idea to familiarize yourself with the type of information companies report each year. Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54. These reports have much more information than the financial statements we have shown you; however, if you read through them you may notice some familiar items.

What Are the Problems with T Accounts?

- A common characteristic of such assets is that they continue providing benefit for a long period of time – usually more than one year.

- Examples of asset accounts are cash, inventory, and account receivable.

- You do this by using a T-account with debits on the left and credits on the right.

- If that’s not the case, make sure to double-check your books as you’ve probably made an accounting error along the way.

- While a journal entry is a record of a single transaction in chronological order, showing the debits and credits of each account affected.

- Debits are always posted on the left side of the t account while credits are always posted on the right side.

- The date of January 3, 2019, is in the far left column, and a description of the transaction follows in the next column.

Since management uses these ledger accounts, journal entries are posted to the ledger accounts regularly. Most companies have computerized accounting systems that update ledger accounts as soon as the journal entries are input into the accounting software. Just like journalizing, posting entries is done throughout each accounting period. Since so many transactions are posted at once, it can be difficult post them all. In order to keep track of transactions, I like to number each journal entry as its debit and credit is added to the T-accounts.

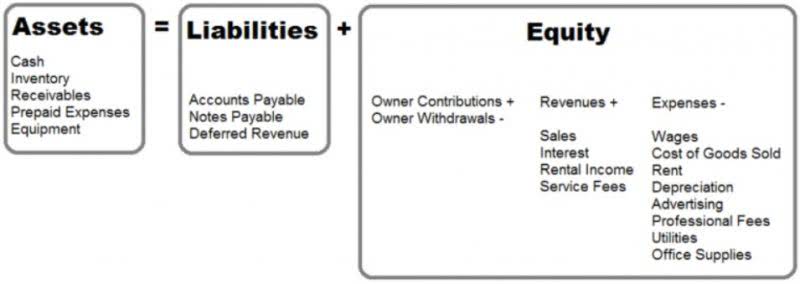

How are the main accounts represented in T accounts?

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. As of October 1, 2017, Starbucks had a total of $1,288,500,000 in stored value card liability. When filling in a journal, there are some rules you need to follow to improve journal entry organization. No matter the account, the debit side is always on the left, and the credit side is always on the right. The terms ”Debit” and “Credit,” which accountants learn on their first day of accounting class, are significant and often used terminology in the field.

It makes the recorded information easier to understand at a glance. T accounts make it easier to manage a double-entry https://www.bookstime.com/bookkeeping-services bookkeeping system. They help record each transaction with its corresponding entry in a different account.

How Are T Accounts Used in Accounting?

I’ve agreed to pay for the coffee machine next month so my accounts payable is increased (credited) by £700. Accounts payable is a liability account, keeping track of bills I still have to pay in future. By breaking transactions down into a simple, digestible form, you can visualise which accounts are being debited and which are being credited. Every financial transaction is first recorded as a journal entry, into the general journal. So, the general journal is the original book of entries that contains the raw financial data of a business.

Do you already work with a financial advisor?

- Data roaming is the use of cellular data services on a mobile device outside of the coverage area of the home network.

- Each category consists of several smaller accounts that break down the specifics of a company’s finances.

- Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company.

- It is typically prepared at the end of an accounting period before financial statements are generated.

- The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500.

- Examples of current assets include cash, cash equivalents, accounts receivable, prepaid expenses, advance payments, short-term investments, and inventories.

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. By arranging entries into a “T,” they guarantee accuracy and consistency in entering financial data by clearly illustrating how each transaction affects various accounts. Debits to revenue and gains can reduce the account balance, while credits increase it. Debits and credits can signify increasing or decreasing for different accounts. However, their T account representations seem the same in terms of left and right positions regarding the “T.” Debits and credits are accounting terms that have been used for hundreds of years and are still in use in the double-entry accounting system today.

However, it can also result in unexpected charges if not managed properly. This article provides an overview of the pros and cons of data roaming, including tips on how to manage data usage on your mobile t account balance sheet device, and how to avoid bill shock. By understanding the potential costs and benefits of data roaming, you can make informed decisions about when and how to use cellular data services while on the go.

Part 2: Your Current Nest Egg

TweetThis entry was posted on Tuesday, November 28th, 2023 at 9:38 pm and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.