Archive for January, 2022

Friday, January 21st, 2022

However, unlike mutual funds which can only be bought or sold at the end-of-day net asset value (NAV), ETF shares can be bought and sold throughout the trading day on public exchanges in the same way as stocks. Debt securities, meanwhile, are borrowed money which must be paid back at the end of a fixed term. Examples of debt securities are corporate and government bonds, collateralised debt obligations and certificates of deposit. Holders are usually entitled to regular interest payments and repayment of principal, though not to voting rights. An initial public offering is when a company issues public stock newly to investors, called an “IPO” for short. A company can later issue more new shares, or issue shares that have been previously registered in a shelf registration.

Stocks can be traded on public exchanges like the New York Stock Exchange (NYSE) or the Nasdaq (not to be confused with the Nasdaq 100 or Nasdaq Composite indexes). Northwestern Mutual is the marketing name for The Northwestern Mutual Life Insurance Company and its subsidiaries. Life and disability insurance, annuities, and life insurance with longterm care benefits are issued by The Northwestern Mutual Life Insurance Company, Milwaukee, WI (NM). Longterm care insurance is issued by Northwestern Long Term Care Insurance Company, Milwaukee, WI, (NLTC) a subsidiary of NM. Investment brokerage services are offered through Northwestern Mutual Investment Services, LLC (NMIS) a subsidiary of NM, brokerdealer, registered investment advisor, and member FINRA and SIPC.

What Are Marketable Securities?

Debt securities generally offer a higher rate of interest than bank deposits, and equities may offer the prospect of capital growth. Equity investment may also offer control of the business of the issuer. Debt holdings may also offer some measure of control to the investor if the company is a fledgling start-up or an old giant undergoing restructuring. In these cases, if interest payments are missed, the creditors may take control of the company and liquidate it to recover some of their investment. Preference shares form an intermediate class of security between equities and debt. If the issuer is liquidated, preference shareholders have the right to receive interest or a return of capital prior to ordinary shareholders.

Companies can offer shares of their projects, as in the case of a tokenized real estate investment, as a crypto asset. However, in other cases, cryptocurrencies are just that — a type of digital currency that can be used to buy and https://investmentsanalysis.info/ sell things both digital and physical. Equity securities represent ownership in a company, partnership, or other business endeavor. As an investor, you generally will have some control over the company’s direction via voting rights.

Eurex Repo average daily volume up 49% YoY for August – Securities Finance Times

Eurex Repo average daily volume up 49% YoY for August.

Posted: Tue, 05 Sep 2023 10:37:43 GMT [source]

Self Regulatory Organizations (SROs) within the brokerage industry often take on regulatory positions as well. Examples of SROs include the National Association of Securities Dealers (NASD), and the Financial Industry Regulatory Authority (FINRA). City, state, or county governments can raise funds for a particular Eur usd trading project by floating a municipal bond issue. Depending on an institution’s market demand or pricing structure, raising capital through securities can be a preferred alternative to financing through a bank loan. They are typically issued for a fixed term, at the end of which they can be redeemed by the issuer.

Money Market Securities

Equity securities generally refer to stocks, which are shares that you purchase in a company. When you buy an equity security, you own a piece of the company and have a stake in how the business performs. Stock performance moves up and down based on many factors, including how the economy is doing, how the business itself is doing, what’s happening in the world and other events you can’t really predict or control.

Dominion Energy’s Ratings Unaffected by Divestiture of Gas … – Fitch Ratings

Dominion Energy’s Ratings Unaffected by Divestiture of Gas ….

Posted: Tue, 05 Sep 2023 20:34:00 GMT [source]

For instance, a 2016 Morgan Stanley report stated security-backed loan sales amounted to $36 billion—a 26% increase compared to the year before. As interest rates continue to increase, financial experts are becoming increasingly concerned that there could be fire sales and forced liquidations when the market turns. Securities lending is important to short selling, in which an investor borrows securities to immediately sell them. The borrower hopes to profit by selling the security and buying it back later at a lower price.

Derivative Securities

The Howey Test is a legal test that is used to determine whether an investment qualifies as a security under U.S. federal law. The test was established by the Supreme Court in the case of SEC v. W.J. Howey Co. in 1946, and it has since become a key tool for securities regulators and investors.

They can deal with the security holder’s possession, right to proprietorship, or loaner transportation. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Securities Regulation

Martinez and her team take a targeted approach, identifying professors at schools like Stanford and National University of Singapore that have a track record of grooming people who thrive at the company. They also unearth students through its Datathons, where participants work through large, complex datasets and present their findings. Griffin’s firms are competing with the likes of Meta, ByteDance Ltd. and Alphabet Inc. among technology giants, along with market-maker rivals including Optiver Holding BV, Jane Street Capital LLC and Susquehanna International Group. The students were split into groups, with each assigned a Citadel staffer to provide guidance but not answers. Over the next few hours, they were expected to create algorithms to hedge their risk and identify arbitrage opportunities, part of the training to help them understand the market-making process.

Consider the case of XYZ, a successful startup interested in raising capital to spur its next stage of growth. Up until now, the startup’s ownership has been divided between its two founders. It can tap public markets by conducting an IPO or it can raise money by offering its shares to investors in a private placement.

In business terms, something is marketable if it can quickly be sold and is non-marketable if it is difficult to sell. In simple terms, the holder of the security has to be able to swiftly and efficiently exchange the asset for others of the same type. Just like a pound sterling note can be replaced by another, a company bond can be swapped for a company bond from the same firm. Compared to, for instance, property, it is relatively easy to convert a security into cash, meaning that people can do so, adding more money to the market and making it more liquid. Various types of securities can be used against each other as a way of hedging against risk.

- Next, consider a government interested in raising money to revive its economy.

- Securities play a vital role in investment portfolios, as they offer investors the opportunity to diversify their holdings and manage risk.

- Equity securities represent ownership of a company in the form of shares of capital stock.

- In terms of proprietary nature, pre-electronic bearer securities were always divided, meaning each security constituted a separate asset, legally distinct from others in the same issue.

- When saving for retirement, most people choose to put a portion of their savings in equity or debt securities.

Stock exchanges such as the NASDAQ and the New York Stock Exchange allow investors to purchase publicly traded securities. Investors can buy securities directly from the issuer if a stock isn’t listed on one of the major stock exchanges. Assuming the share price drops to $75, the investor will then purchase 50 shares for $3,750 (50 shares x $75 price) and return them to the securities firm. In this case, the profit on this short-sale transaction is $1,250 ($5,000 – $3,750). Securities lending is the practice of loaning shares of stock, commodities, derivative contracts, or other securities to other investors or firms. Securities lending requires the borrower to put up collateral, whether cash, other securities, or a letter of credit.

How are Securities in Finance Traded? How it Works

Ownership of securities in this fashion is called beneficial ownership. Bearer securities are completely negotiable and entitle the holder to the rights under the security (e.g., to payment if it is a debt security, and voting if it is an equity security). They are transferred by delivering the instrument from person to person. In some cases, transfer is by endorsement, or signing the back of the instrument, and delivery. The Financial Information Services Division of the Software and Information Industry Association (FISD/SIIA)[8] represents a round-table of market data industry firms, referring to them as Consumers, Exchanges, and Vendors.

Posted in Uncategorized | No Comments »

Wednesday, January 19th, 2022

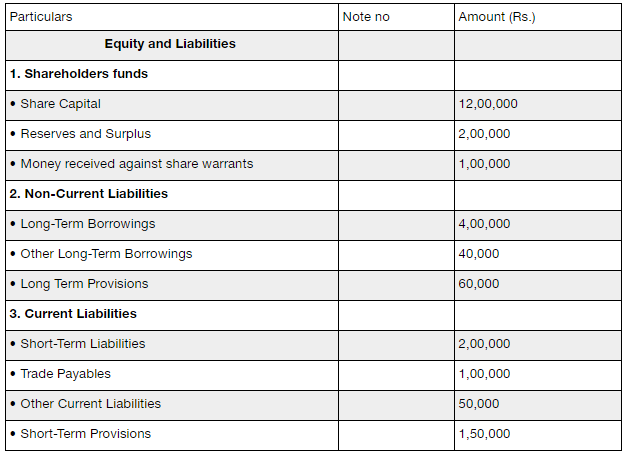

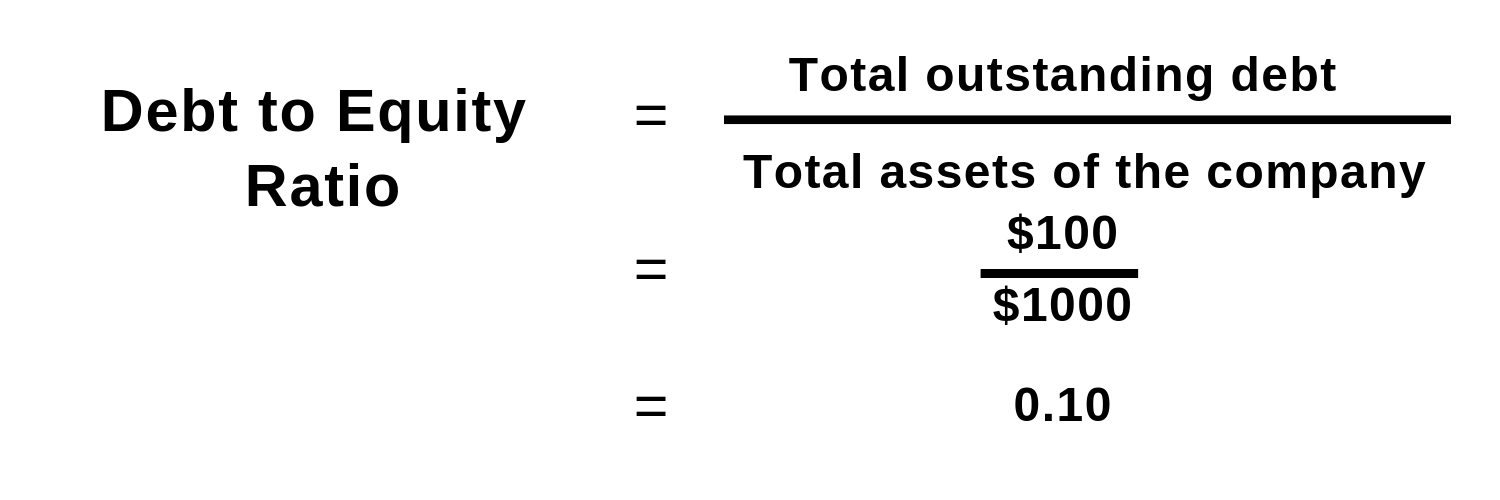

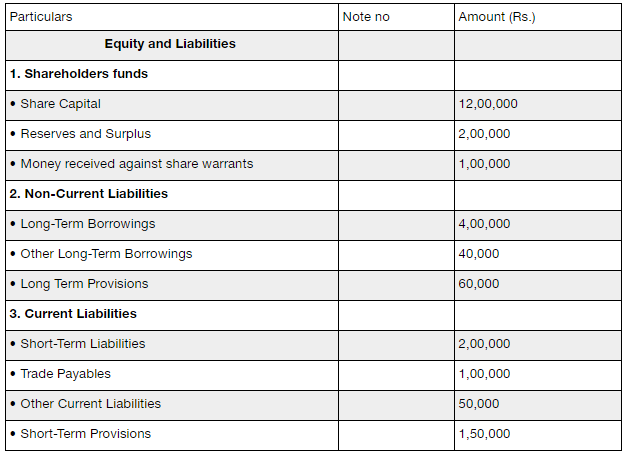

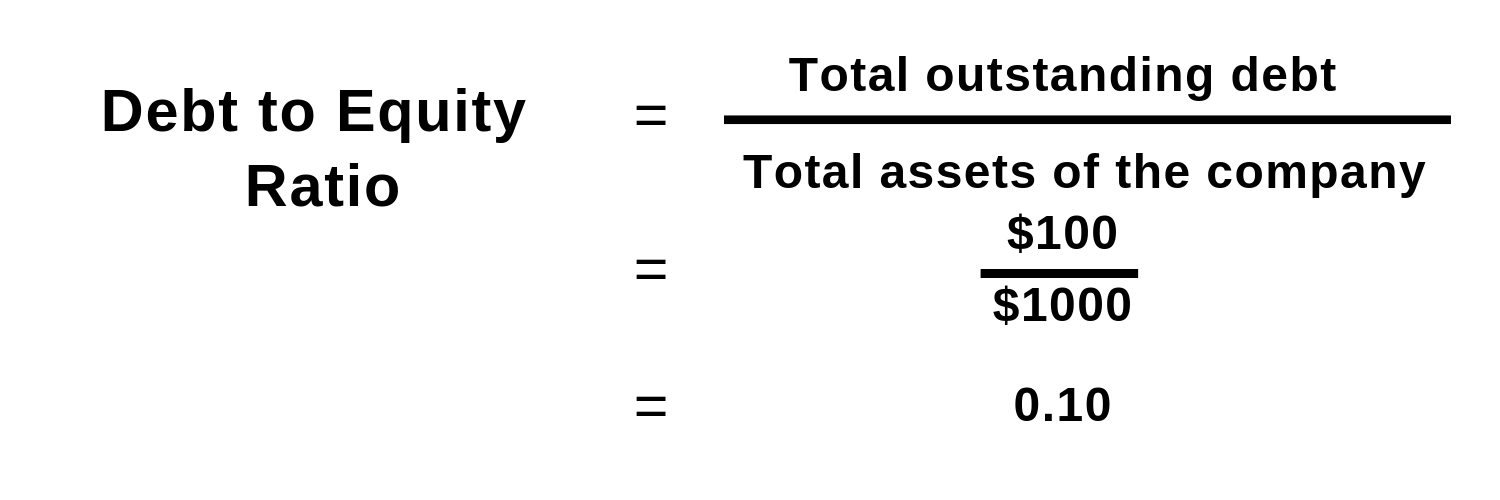

It offers a comparison point to determine whether a company’s debt levels are higher or lower than those of its competitors. As is the story with most financial ratios, you can take the calculation and compare it over time, against competitors, or against benchmarks to truly extract the most valuable information from the ratio. By learning to calculate and interpret this ratio, and by considering the industry context and the company’s financial approach, you equip yourself to make smarter financial decisions. Whether evaluating investment options or weighing business risks, the debt to equity ratio is an essential piece of the puzzle. This number can tell you a lot about a company’s financial health and how it’s managing its money. Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial.

Why You Can Trust Finance Strategists

Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. The company must also hire and train what is the difference between a ledger and a trial balance employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns.

What is a negative debt-to-equity ratio?

For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures. This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. For example, manufacturing companies tend to have a ratio in the range of 2–5.

What is your current financial priority?

The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

The debt to equity ratio is considered a balance sheet ratio because all of the elements are reported on the balance sheet. Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as copyrights and owned brands. Because the total debt to assets ratio includes more of a company’s liabilities, this number is almost always higher than a company’s long-term debt to assets ratio. Acceptable levels of the total debt service ratio range from the mid-30s to the low-40s in percentage terms. Last, businesses in the same industry can be contrasted using their debt ratios.

Advantages and Disadvantages of the Debt Ratio

Wise use of debt can help companies build a good reputation with creditors, which, in turn, will allow them to borrow more money for potential future growth. Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. A highly leveraged company with a high D/E ratio faces increased financial risk. During economic downturns or challenging market conditions, the company may struggle to meet debt obligations, leading to potential default and loss of investor confidence. Yes, different industries have varying capital requirements and risk profiles, leading to sector-specific benchmarks for the debt/equity ratio. It is essential to compare a company’s D/E ratio with industry peers to gain meaningful insights.

- Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial.

- Using excel or another spreadsheet to calculate the D/E is relatively straightforward.

- The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022.

- The debt-to-equity ratio divides total liabilities by total shareholders’ equity, revealing the amount of leverage a company is using to finance its operations.

- In the realm of corporate finance, understanding a company’s financial leverage is critical for investors, creditors, and analysts alike.

Gearing ratios are financial ratios that indicate how a company is using its leverage. The formula for calculating the debt-to-equity ratio (D/E) is equal to the total debt divided by total shareholders equity. For a mature company, a high D/E ratio can be a sign of trouble that the firm will not be able to service its debts and can eventually lead to a credit event such as default.

If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry.

It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either. For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly. This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest. Most of the information needed to calculate these ratios appears on a company’s balance sheet, save for EBIT, which appears on its profit and loss statement. But let’s say Company A has $2 million in long-term liabilities, and $500,000 in short-term liabilities, whereas Company B has $1.5 million in long-term debt and $1 million in short term debt.

It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy. In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet. However, this will also vary depending on the stage of the company’s growth and its industry sector.

Posted in Uncategorized | No Comments »

Monday, January 17th, 2022

Вторая по популярности криптовалюта Etherium (эфир) была анонсирована 30 июля 2015 года. Капитализация Ethereum превысила $1 млрд весной 2016 года, а уже летом 2017 года выросла до $22,6 млрд. По прогнозам финансовых аналитиков, к концу 2018 году Ethereum может превзойти биткоин по капитализации. В этом году заморозки привели к гибели более 1 млн га посевов, из которых около 850 тыс. Но, учитывая масштабы ущерба, по части из них планируется введение ЧС федерального значения, сказал вице-премьер. На Ethereum многие возлагают большие надежды в связи с запуском спотовых ETF, однако список внутренних проблем сети продолжает расширяться.

Курсы криптовалют онлайн в реальном времени. График и цена на сегодня

А американский предприниматель и хедж-фонд менеджер Джеймс Альтушер считает, что криптовалюты в 2018 году дойдут до той точки технического развития, когда их преимущество перед фиатными деньгами станет очевидно. Вполне можно ожидать того, что должен повыситься уровень защиты как отдельных криптовалют, так и связанных с ними ресурсов — бирж, кошельков и др. Также среди ожидаемых технических нововведений — блокчейны, которые смогут подстраиваться под нужды любого человека.

Прогноз цен VIDT Datalink (VIDT) на 2032 год

По прогнозу заведующей отделом прикладной метеорологии и климатологии Украинского гидрометеорологического института ГСЧС и НАН Украины Веры Балабух, температура воздуха летом в Украине будет на 1-2 градуса выше, чем обычно. Барри Пене — строгий исследователь/копирайтер в области блокчейна. Барри торгует криптовалютой с 2017 года и инвестировал в вопросы, которые поставили бы блокчейн-индустрию на правильный пьедестал. Исследовательский опыт Барри охватывает блокчейн как прорывную технологию, DeFis, NFT, Web3 и снижение уровня энергопотребления при добыче криптовалюты. Создайте свою учетную запись ниже, чтобы получать эксклюзивный доступ к широкому спектру торговых инструментов, таких как премиальные прогнозы цен VIDT Datalink, расширенные сигналы покупки/продажи VIDT и многое другое. В качестве основной цели платформа создает облачные данные для цепных соединений с помощью уникального метода, который работает с минимальными затратами и усилиями для проверки цифровых элементов.

Префы Мечел прогноз. Цена префов MTLRP

- Гибридный блокчейн обеспечивает целостность цифровых активов и документов в зашифрованном виде через API платформы.

- Исследовательский опыт Барри охватывает блокчейн как прорывную технологию, DeFis, NFT, Web3 и снижение уровня энергопотребления при добыче криптовалюты.

- В 2019 году VIDT Datalink использовался для интеграции произведения искусства Рембрандта в блокчейн.

- Фактически это продолжение тенденции роста средних температур на протяжении последних лет.

- В этом году заморозки привели к гибели более 1 млн га посевов, из которых около 850 тыс.

- Какие преимущества использование криптовалют предоставляет пользователям?

Днем воздух прогреется до +23…+28 °С, а на юге и востоке – до +28…+33 °С. По мнению искусственного интеллекта, если проект создания стейблкоинов завершится успешно и приведёт к росту ликвидности и спроса на XRP, то криптовалюта подорожает более чем вдвое от текущего показателя. Если же новые активы со стабильным курсом не заинтересуют членов криптосообщества, то XRP грозит 42%-ное падение курса. Если VIDT Datalink https://www.tokenexus.com/ успешно повысит рыночные настроения среди энтузиастов криптовалюты, цена монеты VIDT может оставаться стабильной в течение следующих пяти лет. Наши прогнозы цен используют рыночные данные VIDT Datalink (VIDT) в режиме реального времени, и все данные обновляются в режиме реального времени на нашем веб-сайте. Это позволяет нам предоставлять динамические прогнозы цен на основе текущей рыночной активности.

- Собственный токен VIDT Datalink VIDT является основной частью платформы и необходим для создания и защиты данных на платформе.

- В понедельник, 3 июня, ночью на востоке, днем на севере и западе страны пройдут дожди с грозами.

- В то же время на остальной территории ожидаются грозовые дожди и местами град.

- В зависимости от стратегии ставок, используемой отдельным лицом, инвестор может заработать более 100% своих инвестиций на вариантах ставок протокола.

- Happycoin.club – Продвинутая версия виртуального помощника ChatGPT-4o сделала прогноз на изменение курса XRP после того, как эмитент криптовалюты компания Ripple выпустит стейблкоины.

В зависимости от стратегии ставок, используемой отдельным лицом, инвестор может заработать более 100% своих инвестиций на вариантах ставок протокола. Смарт-контракт VIDT был запущен на Бинанс Smart Chain (BSC), но допускает периодическую пакетную привязку, которая может быть записана в сетях блокчейнов Биткойн и Эфириум. Платформа открыта для пользователей, что позволяет регистрировать файлы на платформе, но при этом создается хэш блокчейна, рассматриваемый как длинная строка чисел. Каждый раз, когда файл обновляется, хэш меняется, что делает хранилище файлов прозрачным и позволяет легко обнаруживать мошенничество или изменения.

На западе и в центральной части Украины ожидаются кратковременные грозовые дожди, однако в западных регионах во второй половине дня местами сильные ливни, град и шквалы. Ночью температура воздуха будет Как купить VIDT +12…+17 °С, а днем +23…+28 °С. VIDT Datalink — это многофункциональный протокол проверки блокчейна и создания NFT, который направлен на защиту цифровых файлов и активов от сетевых атак и хакеров.

- Каждый раз, когда пользователь хочет создать или обновить файл, выполняется транзакция VIDT, которая отмечает изменения в файле.

- VIDT – это собственный токен платформы проверки данных на основе блокчейна V-ID Datalink.

- Каждая новая цифровая монета отличается от предшествующей и является уже новой цепочкой.

- Ферма состоит из множества видеокарт с мощными графическими процессорами, которые добывают новую криптовалюту.

- Формировать приватные блокчейны смогут частные лица и компании, а публичный вариант будут использовать, например, разработчики, которым важно повысить уровень доверия к своему продукту.

- После успешной транзакции токен VIDT вычитается из кошелька человека в качестве платы за газ.

Posted in Uncategorized | No Comments »

Thursday, January 6th, 2022

Opublikowane dotychczas przez GUS informacje dotyczące gospodarstw domowych uwzględniają większą liczbę Informacje o ic markets polskich gospodarstw domowych (wzrost o 1,8 proc. w porównaniu do roku 2002). Opisana została także struktura gospodarstw Buffett wskaźnik ostrzega przed załamaniem na giełdzie według miejsca zamieszkania, z której wynika, że w stosunku do roku 2002, liczba gospodarstw domowych Handel kontraktami futures i opcjami w Indiach w miastach wzrosła o 2,1 proc., natomiast liczba gospodarstw znajdujących się na wsi o 1,1 proc.

Posted in Uncategorized | No Comments »