What Is A Put Option?: A Guide To Buying And Selling

This post was written by Kenon Thompson on January 26, 2021

It’s important to identify a broker that is a good match for your investment needs. Calls work similarly to puts, but rather than giving the owner the right to sell a stock at a specific price, they give the owner the right to buy a stock at a specific price. If the stock stays at the strike price or above it, the put is “out of the money,” so the put seller pockets the premium. The seller can write another put on the stock, if the seller wants to try to earn more income.

An investor can also write a put option for another investor to buy, in which case, she would not expect the stock’s price to drop below the exercise price. It really depends on factors such as your trading objective, risk appetite, amount of capital, etc. The dollar outlay for in the money (ITM) puts is higher than for out of the money (OTM) puts because they give you the right to sell the underlying security at a higher price. But the lower price for OTM puts is offset by the fact that they also have a lower probability of being profitable by expiration. If you don’t want to spend too much for protective puts and are willing to accept the risk of a modest decline in your portfolio, then OTM puts might be the way to go.

Editorial integrity

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance. Jennifer Agee has been editing financial education since 2001, including publications focused on technical analysis, stock and options trading, investing, and personal finance.

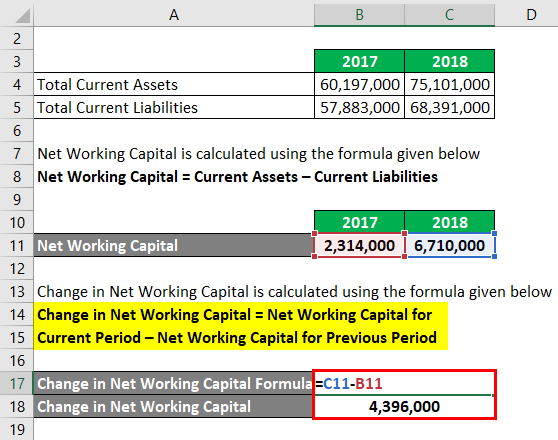

Create a free account to unlock this Template

If the price of the underlying stock falls below the strike price before the expiration date, the buyer stands to make a profit on the sale. The buyer has the right to sell the puts, while the seller has the obligation and must buy the puts at the specified strike price. However, if the puts remain at the same price or above the strike price, the buyer stands to make a loss. A put option is a contract that allows an investor to sell a particular security, or other investment at a particular price for a specific amount of time. In the context of insurance, put options exist for life insurance policies.

Course Spotlight: Why you should tail those who fade the ball at … – PGA TOUR

Course Spotlight: Why you should tail those who fade the ball at ….

Posted: Wed, 09 Aug 2023 22:20:07 GMT [source]

A put option is the reverse of a call option, where the holder has the right, but not the obligation, to buy shares. Despite that, it doesn’t mean that these economic setbacks are any less painful. Most investors are aware that the stock market does go through phases of expansion and contraction. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Where have you heard about put options?

That is, the buyer wants the value of the put option to increase by a decline in the price of the underlying asset below the strike price. The writer (seller) of a put is long on the underlying asset and short on the put option itself. That is, the seller wants the option to become worthless by an increase in the price of the underlying asset above the strike price. Generally, a put option that is purchased is referred to as a long put and a put option that is sold is referred to as a short put. A put option gives the holder the right, but not the obligation, to sell a stock at a certain price in the future. When an investor purchases a put, she expects the underlying asset to decline in price; she may sell the option and gain a profit.

His net profit is $700 ($1000 – $300 option price]. However, if the stock price remains above the strike price, the (put) option will expire worthless. John’s loss from the investment will be capped at the price paid for the put. Suppose you hang on to the contract through expiration, but the stock price remains well above the strike price. The option would expire worthless and you’d only forego the $500 premium paid upfront for exposure to the theoretical equivalent of 100 shares of short stock. Put options work through an agreement, between a buyer and a seller, to exchange an underlying asset at a predetermined price by a certain expiration date.

Investors could short sell the stock at the current higher market price, rather than exercising an out of the money put option at an undesirable strike price. In general, the value of a put option decreases as its time to expiration approaches because of the impact of time decay. Time decay accelerates as an option’s time to expiration draws closer since there’s less time to realize a profit from the trade. An option’s intrinsic value is equivalent to the difference between the strike price and the underlying stock price. If an option has intrinsic value, it is referred to as in the money (ITM).

- Tastytrade and Marketing Agent are separate entities with their own products and services.

- If the stock price remains well above the strike price through expiration, you’d keep the credit received up front as profit.

- Potential losses could exceed any initial investment and could amount to as much as the entire value of the stock, if the underlying stock price went to $0.

- Derivatives are financial instruments that derive value from price movements in their underlying assets, which can be a commodity such as gold or stock.

- A stockholder can purchase a “protective” put on an underlying stock to help hedge or offset the risk of loss from the stock price falling.

The two main types of derivatives used for stocks are put and call options. If units of SPY fall to $415 prior to expiration, the $425 put will be “in the money” and will trade at a minimum of $10, which is the put option’s intrinsic value (i.e., $425 – $415). The exact price for the put would depend on a number of factors, the most important of which is the time remaining to expiration. You can make money from a put option if your speculation of the market movement is correct. As a long put holder, you can either sell the contact before expiry for a profit if there is a swift bearish movement in the stock price.

Sellers expect the stock to stay flat or rise above the strike price, making the put worthless. If the stock finishes between $37 and $40 per share at expiration, the put option will have some value left on it, but the trader will lose money overall. And above $40 per share, the put expires worthless and the buyer loses the entire investment. Assume an investor is bullish on SPY, which is currently trading at $445, and does not believe it will fall below $430 over the next month. The investor could collect a premium of $3.45 per share (× 100 shares, or $345) by writing one put option on SPY with a strike price of $430. Puts with a strike price of $50 are available for a $5 premium and expire in six months.

How we make money

Conversely, it’s “out of the money” (worthless) when the market price of the underlying stock is below the strike price. Puts with a strike price of $50 can be sold for a $5 premium and expire in six months. Buying puts offers better profit potential than short selling if the stock declines substantially. The put buyer’s entire investment can be lost if the stock doesn’t decline below the strike by expiration, but the loss is capped at the initial investment. Because one contract represents 100 shares, for every $1 decrease in the stock’s market price below the strike price, the total value of the option increases by $100. A stockholder can purchase a “protective” put on an underlying stock to help hedge or offset the risk of loss from the stock price falling.

At $45, the trade has already made a profit, while the put buyer has just broken even. The biggest advantage for short-sellers, though, is that they have a longer time horizon for the stock to decline. While options eventually expire, a short-seller need not close out a short-sold position, as long as the brokerage account has enough capital to maintain it. The owner of a put option profits when the stock price declines below the strike price before the expiration period. The put buyer can exercise the option at the strike price within the specified expiration period.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Our goal is to give you the best advice to help you make smart personal finance decisions.

- NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

- Tasty Software Solutions, LLC is a separate but affiliate company of tastylive, Inc.

- Put owners don’t have to own the physical asset to secure the right to sell it if they exercise the option, which limits their monetary risk.

- The investor could collect a premium of $3.45 per share (× 100 shares, or $345) by writing one put option on SPY with a strike price of $430.

- If the strike price of a put option is $20, and the underlying is stock is currently trading at $19, there is $1 of intrinsic value in the option.

If the underlying stock’s market price is below the option’s strike price when expiration arrives, the option owner (buyer) can exercise the put option, forcing the writer to buy the underlying stock at the strike price. That allows the exerciser (buyer) to profit from the difference between the stock’s market price and the option’s strike price. But if the stock’s market price is above the option’s strike price at the end of expiration day, the option expires worthless, and the owner’s loss is limited to the premium (fee) paid for it (the writer’s profit). The right to sell the underlying asset is secured through paying a premium to hold the theoretical equivalent of 100 short shares of stock below the put strike for a limited amount of time. Since put buyers don’t have an obligation to short-sell the 100 shares, they can go the alternative route of letting the option expire worthless and only give up the premium paid up front. This is typically done if the stock price stays above the strike price.

Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero. If the market price is lower than the strike price at maturity, the investor can decide whether he will sell his option or not, but the seller is obliged to buy the security at the strike price. We want to clarify that IG International does not have an official Line account at this time.

Contrary to a long put option, a short or written put option obligates an investor to take delivery, or purchase shares, of the underlying stock at the strike price specified in the option contract. Assume an investor buys one define put option put option on the SPDR S&P 500 ETF (SPY), which was trading at $445 (January 2022), with a strike price of $425 expiring in one month. For this option, they paid a premium of $2.80, or $280 ($2.80 × 100 shares or units).

TweetThis entry was posted on Tuesday, January 26th, 2021 at 4:11 am and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.